This weeks’ announcement that Visa had launched a new, all-digital loyalty platform for its Latin American and Caribbean bank partners could have been just another blip on the continuum of interesting fintech developments – there are a lot of them these days. But I think this announcement bears some examination.

By Mike Giambattista, CLMP

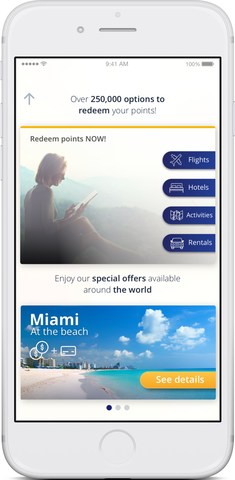

The press release describes the new platform as a “white-label solution (which) enables issuing member banks of any size to offer top-of-the-line rewards and customer care programs they can adapt to their loyalty strategies and brand as their own. (It) features a user-friendly mobile app and web portal, as well as chat and voice, to make points redemption and customer service faster and easier for cardholders and financial institutions around the region.” After a cursory walk through of the promotional demo, it’s clear that Visa and their tech partner Novae, have put a lot of thought into the user experience.

Beyond the tech “wow” factor though, Visa may have just scored a massive win in the region. Consider how many banks are currently Visa partners (virtually all of them) and you get a sense of the value of this effort.

If this new platform genuinely delivers on the “omnichannel digital points redemption” promise, and if it’s true that banks of any size can easily integrate it into their loyalty strategies, then Visa Loyalty Solutions may have just rolled their wooden horse right past the moat and into the castle. The size of their market and their existing access to it could create instant market dominance.

Operationally, one wonders what it will take to onboard thousands of institutions – no doubt, a herculean task. Visa certainly has the resources, but will they be able to deploy them efficiently enough to keep their massive partner base functional and happy throughout the process?

On the consumer side, the new platform offers something akin to concierge-level customer service. And though they don’t bill it as such, the demo gives you a sense that they really want their users to feel a high sense of value and touch. But that will also come at a cost.

The mobile app makes it very easy to manage & redeem – those are purely technological functions. But having a ready base of customer service reps armed with the right information to assist with help requests and travel arrangements takes manpower. And in this case, lots of it.

Visa says the new platform allows cardholders the ability to redeem points and get preferential deals at more than 285,000 establishments worldwide - so there is clear value to the consumer. And they appear to have developed a product that has a high degree of utility and adaptability for their bank partners. Let’s see if the company can manage the adoption processes well and take the control of this valuable territory. I’m betting they can.

Mike Giambattista is Editor in Chief at The Wise Marketer and is a Certified Loyalty Marketing Professional (CLMP).